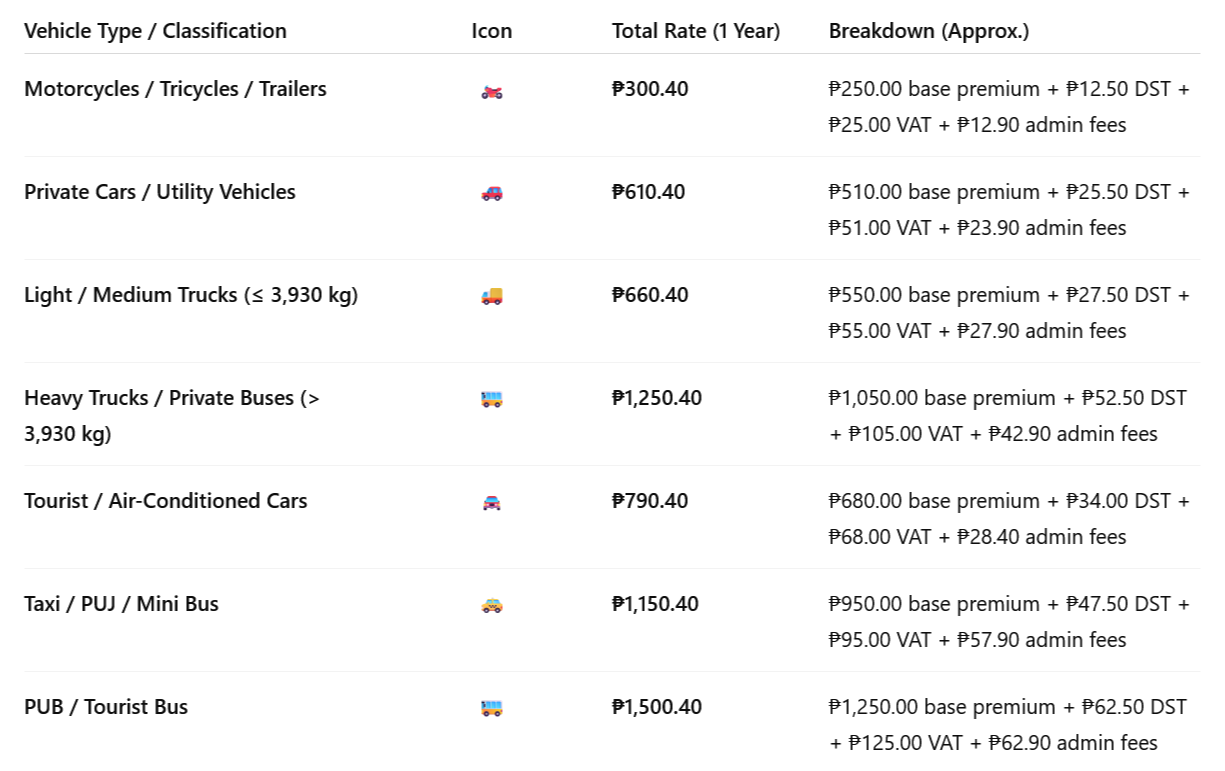

Standardized Pricing

CTPL rates are standardized and regulated by the Insurance Commission (IC), which means all accredited insurance companies must follow the same base premium schedule per vehicle type, they cannot freely set their own CTPL prices.

The only differences between insurers typically come from small administrative or processing fees.

These rates ensure:

-

Fairness (no price undercutting or overcharging)

-

Transparency (LTO and IC can easily verify)

-

Uniform protection (same coverage and liability limits for all road users)

For example, a private car CTPL policy is ₱610.40 no matter which accredited insurer you buy from, unless there are additional convenience or digital processing fees.

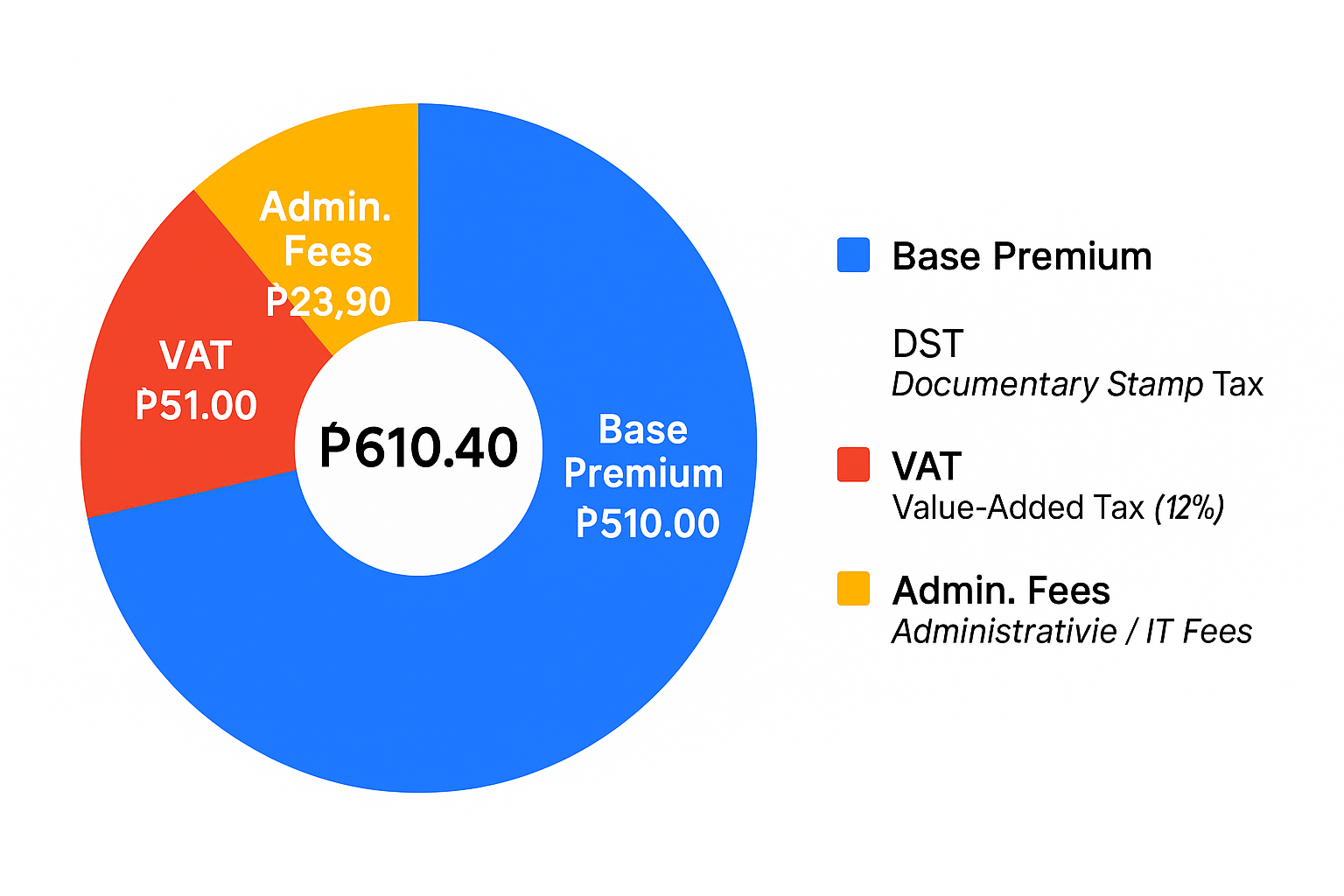

What the Fee Components Mean

A CTPL insurance payment is composed of four main parts, each serving a specific purpose in the policy’s total cost:

-

Base Premium – This is the actual insurance cost that covers the risk of third-party liability. It funds the payment of claims for accidents, injuries, or deaths caused by the insured vehicle.

-

Documentary Stamp Tax (DST) – A government-mandated tax applied to all insurance policies under the National Internal Revenue Code, typically amounting to ₱0.50 for every ₱200 of the premium.

-

Value-Added Tax (VAT, 12%) – The standard 12% sales tax imposed on the premium and related service components. This amount is remitted to the Bureau of Internal Revenue (BIR).

-

Administrative / LGU / IT Fees – These cover policy issuance, LTO electronic validation, Insurance Commission data interconnectivity, and other small operational costs such as printing or system maintenance. These usually range from ₱20 to ₱60, depending on the insurer.

Together, these components make up the total CTPL premium that vehicle owners pay when registering or renewing their motor vehicle insurance in the Philippines.