You Need CTPL as it's a Legal Requirement

CTPL, or Compulsory Third Party Liability insurance, is a legal requirement for all vehicle owners in the Philippines before they can register or renew their car registration with the LTO. It provides basic protection by covering injury or death of third parties (people outside the insured vehicle) resulting from an accident involving the vehicle. However, CTPL has limited coverage, it does not cover damage to your own car, theft, or injury to passengers, the driver, or the owner. For broader protection, vehicle owners typically purchase Comprehensive Car Insurance, which includes coverage for accidents, theft, natural disasters, property damage, and personal injury, offering far more financial security than the minimum CTPL requirement.

CTPL Law

The requirement for CTPL comes from:

-

Section 387 of the Insurance Code of the Philippines (Presidential Decree No. 612, as amended)

It mandates that no motor vehicle shall be registered or renewed unless it is covered by a CTPL policy issued by an authorized insurer. -

Land Transportation Office (LTO) regulations reinforce this requirement. You can’t register a vehicle without showing proof of valid CTPL coverage.

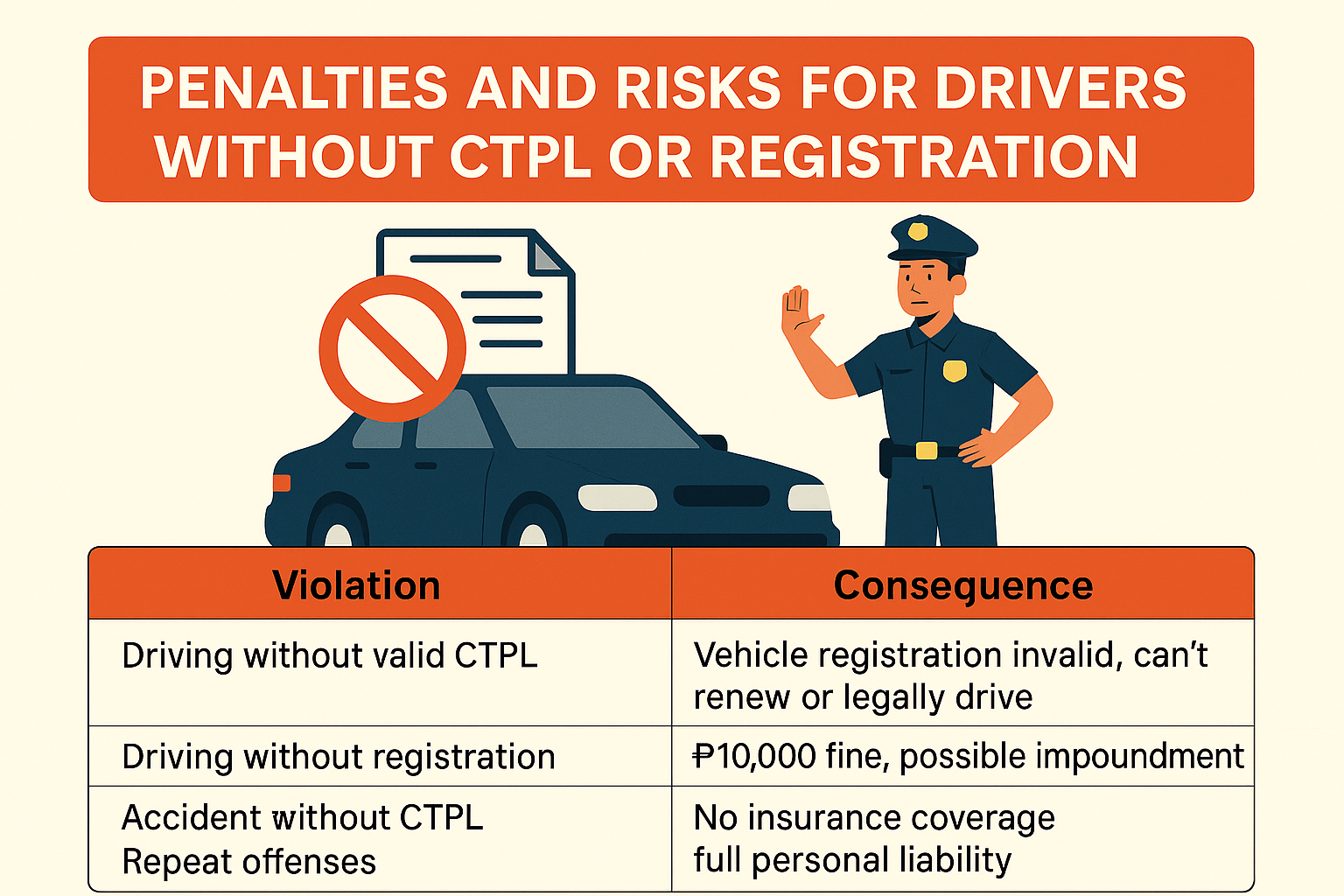

If you drive in the Philippines without CTPL insurance or a valid car registration, you are violating multiple laws, and the consequences can be serious, both legally and financially. Here’s a summary below:

| Violation | Consequence |

|---|---|

| Driving without valid CTPL | Vehicle registration invalid |

| Driving without registration | ₱10,000 fine, possible impoundment |

| Accident without CTPL | No insurance, full personal liability |

| Repeat offenses | Possible license suspension or penalties |

CTPL Benefits

Key Notes on CTPL Benefits (as of IMC No. 2024-01)

1. Mandatory Coverage for Registration

-

CTPL insurance is required by law before a vehicle can be registered or renewed at the Land Transportation Office (LTO).

-

Every vehicle, regardless of type or ownership, must have valid CTPL coverage for the entire registration period (usually one year).

2. Covers Only Third Parties

-

“Third parties” are people outside the insured vehicle — pedestrians, cyclists, or other motorists injured or killed due to the insured vehicle’s fault.

-

It does not cover the driver, owner, or passengers of the insured vehicle.

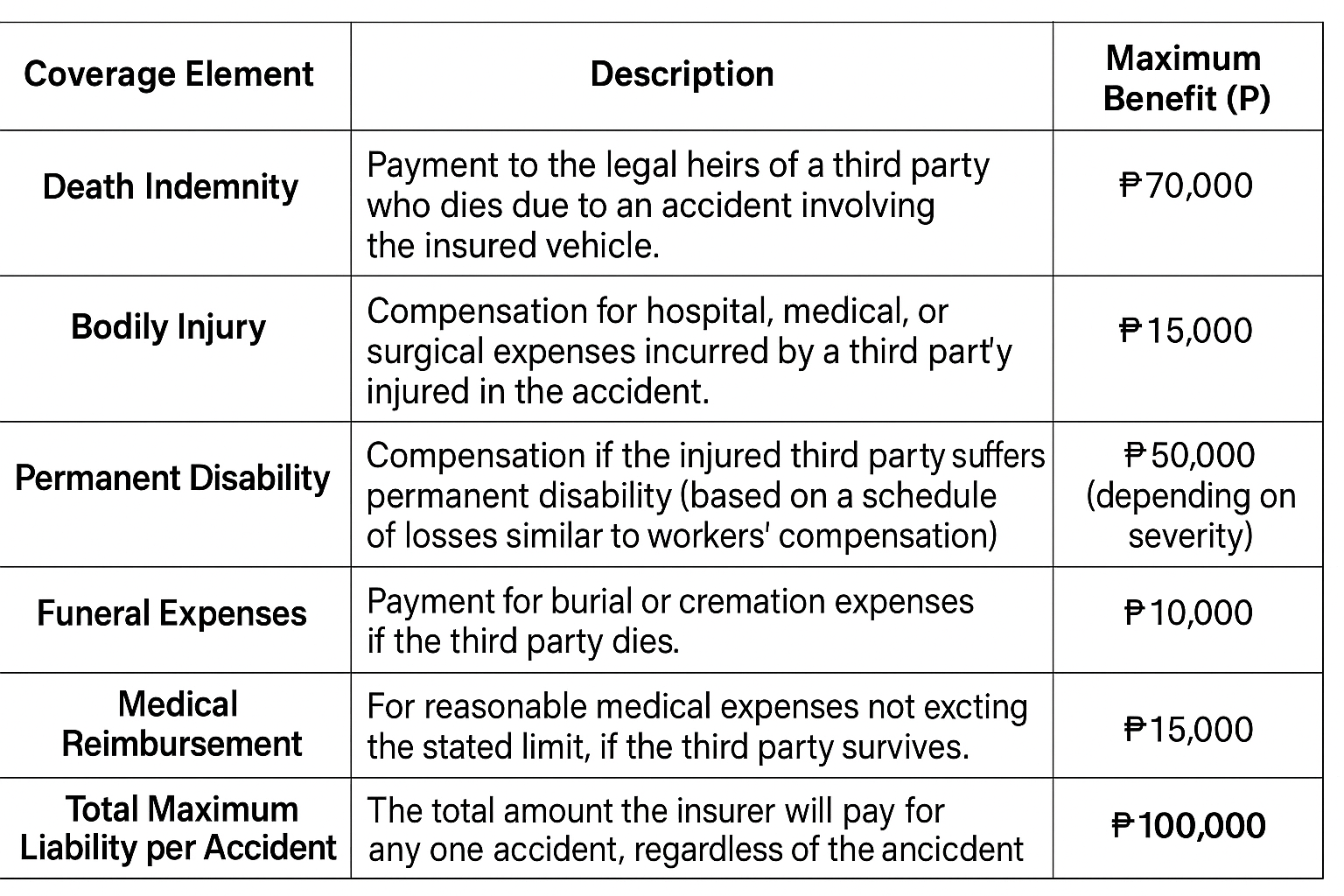

3. Updated Benefit Limits

As per Insurance Memorandum Circular No. 2024-01, the limits were doubled to reflect modern costs of injury and death compensation:

-

₱200,000 total liability per accident

-

₱200,000 for death or permanent disability

-

₱30,000 for bodily injury / medical / funeral expenses

-

₱30,000 “no-fault indemnity”, paid even without proving negligence

4. No-Fault Indemnity Clause

-

Victims (or their heirs) can claim up to ₱30,000 immediately from the insurer without needing to prove fault or negligence.

-

This allows faster relief for medical or funeral costs right after an accident.

5. Proof and Claim Process

-

Claims must be supported by:

-

Police report of the accident

-

Medical or death certificate

-

Proof of expenses or receipts

-

-

The insurer directly pays the third party or heirs, not the vehicle owner.

6. Exclusions

CTPL does not cover:

-

Damage to property (vehicles, buildings, etc.)

-

Injuries to passengers, the driver, or the owner of the insured car

-

Theft, fire, or natural disasters

For these risks, Comprehensive Car Insurance is recommended.

Real-World Example:

Scenario:

Anna owns a sedan and has a valid CTPL policy. While driving in Quezon City, she accidentally hits a pedestrian who crosses suddenly, resulting in a leg fracture and hospitalization.

How CTPL Works:

-

The pedestrian (third party) files a claim under Anna’s CTPL.

-

The hospital issues a medical report and receipts totaling ₱28,000.

-

Under CTPL, Anna’s insurer covers ₱28,000 of the pedestrian’s medical expenses — not Anna herself.

-

If the pedestrian had died (hypothetically), Anna’s insurer would pay ₱200,000 to the victim’s heirs as death indemnity plus ₱30,000 for funeral expenses.

Outcome:

Anna’s insurer shoulders the third party’s costs — protecting her from direct financial liability. However, Anna’s car repair is not covered by CTPL; she would need comprehensive insurance for that.